Tractor Retail Sales Report March 2024: Mahindra & Mahindra Leads the Market

0 Views

Updated On:

In March 2024, Mahindra & Mahindra dominates tractor sales. Overall market sees growth, reflecting resilience amid agricultural challenges.

Key Highlights

- March 2024 sees Mahindra & Mahindra leading tractor sales.

- Overall market experiences growth despite challenges.

- Mahindra's Swaraj Division also performs well.

- International Tractors, TAFE, Escorts, and John Deere maintain a market presence.

- Eicher, CNH Industrial, Kubota, V.S.T. Tillers, and Gromax contribute to market share.

- Other manufacturers collectively account for significant sales.

In March 2024, the Indian tractor market experienced a significant rise in sales, reflecting the resilience of the agricultural sector despite various challenges. The month witnessed a growth in demand for tractors, with several leading Original Equipment Manufacturers (OEMs) reporting notable figures.

Also Read: Domestic Tractor Sales Declined by 22.67% in March 2024: 63,755 Units Sold

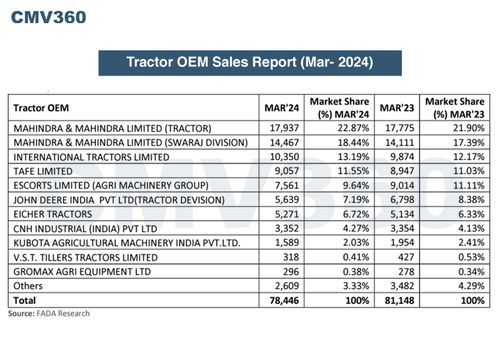

Tractor OEMs: March 2024 Sales

Mahindra & Mahindra Limited (Tractor)

Mahindra & Mahindra Limited emerges as the frontrunner in the tractor market for March 2024. With a total of 17,937 units sold, the company captured a substantial market share of 22.87%. This performance indicates a slight increase compared to March 2023, where they held a market share of 21.90%, with sales reaching 17,775 units.

Mahindra & Mahindra Limited (Swaraj Division)

The Swaraj Division of Mahindra & Mahindra also made significant strides, securing an 18.44% market share with 14,467 units sold in March 2024. This marks a slight improvement from March 2023, when the division held a market share of 17.39%, with sales reaching 14,111 units.

International Tractors Limited

International Tractors Limited witnessed an admirable performance in March 2024, with sales totaling 10,350 units, representing a market share of 13.19%. This reflects a positive growth trajectory compared to March 2023, where the company's market share stood at 12.17%, with sales of 9,874 units.

TAFE Limited

TAFE Limited reported encouraging sales figures in March 2024, with 9,057 units sold, changing to a market share of 11.55%. The company's performance remained steady compared to March 2023, where it held a similar market share of 11.03%, with sales amounting to 8,947 units.

Escorts Limited (Agri Machinery Group)

Escorts Limited's Agri Machinery Group witnessed a slight decline in market share in March 2024, capturing 9.64% with 7,561 units sold. This is in contrast to March 2023, where the company held a market share of 11.11%, with sales totaling 9,014 units.

John Deere India Pvt Ltd (Tractor Division)

John Deere India Pvt Ltd's Tractor Division reported sales of 5,639 units in March 2024, representing a market share of 7.19%. However, the company experienced a marginal decrease compared to March 2023, where it held a market share of 8.38%, with sales reaching 6,798 units.

Eicher Tractors

Eicher Tractors witnessed a steady performance in March 2024, with sales totaling 5,271 units and a market share of 6.72%. This reflects a similar market share compared to March 2023, where the company held 6.33% with sales of 5,134 units.

CNH Industrial (India) Pvt Ltd

CNH Industrial (India) Pvt Ltd reported sales of 3,352 units in March 2024, translating to a market share of 4.27%. The company's performance remained relatively stable compared to March 2023, where it held a market share of 4.13%, with sales amounting to 3,354 units.

Kubota Agricultural Machinery India Pvt Ltd

Kubota Agricultural Machinery India Pvt Ltd witnessed a slight decrease in market share in March 2024, capturing 2.03% with sales of 1,589 units. This is in contrast to March 2023, where the company held a market share of 2.41%, with sales totaling 1,954 units.

Also Read: Kubota India Introduces K3R Brand as Quality & Affordable Spare Parts Solution

V.S.T. Tillers Tractors Limited

V.S.T. Tillers Tractors Limited reported sales of 318 units in March 2024, representing a market share of 0.41%. The company experienced a decline compared to March 2023, where it held a market share of 0.53%, with sales amounting to 427 units.

Gromax Agri Equipment Ltd

Gromax Agri Equipment Ltd witnessed a marginal increase in market share in March 2024, capturing 0.38% with sales totaling 296 units. This reflects a slight improvement from March 2023, when the company held a market share of 0.34%, with sales of 278 units.

Other Manufacturers

Other manufacturers collectively accounted for 3.33% of the market share in March 2024, with sales reaching 2,609 units. This represents a slight decrease compared to March 2023, where they held a market share of 4.29%, with sales amounting to 3,482 units.

Industry Insights

The performance of the tractor industry in March 2024 reflects the resilience and adaptability of the agricultural sector in India. Despite various economic and logistical challenges, farmers continue to invest in mechanization to enhance productivity and efficiency in farming operations.

Market Dynamics

Several factors contribute to the Growth in tractor sales. These include favorable government policies, increased mechanization in agriculture, rising demand for farm equipment, and efforts to modernize farming practices. Additionally, factors such as improved access to credit facilities for farmers and a robust monsoon forecast for the upcoming season have reinforced confidence in agricultural investments.

Outlook

The outlook for the tractor industry remains optimistic as it continues to play a pivotal role in driving agricultural growth and rural development. OEMs are expected to focus on innovation, technological advancements, and customer-centric strategies to meet the evolving needs of farmers and sustain the momentum in tractor sales.

Also Read: Domestic Tractor Sales Witness a Decline of 7.07% in FY24: Industry Reports 8,74,504 Tractors Sold

CMV360 Says

The March 2024 sales figures underscore the importance of the tractor industry in supporting agricultural sustainability and food security in India. With Mahindra & Mahindra leading the pack, the sector is assured of further growth and innovation in the coming months.