Ad

Ad

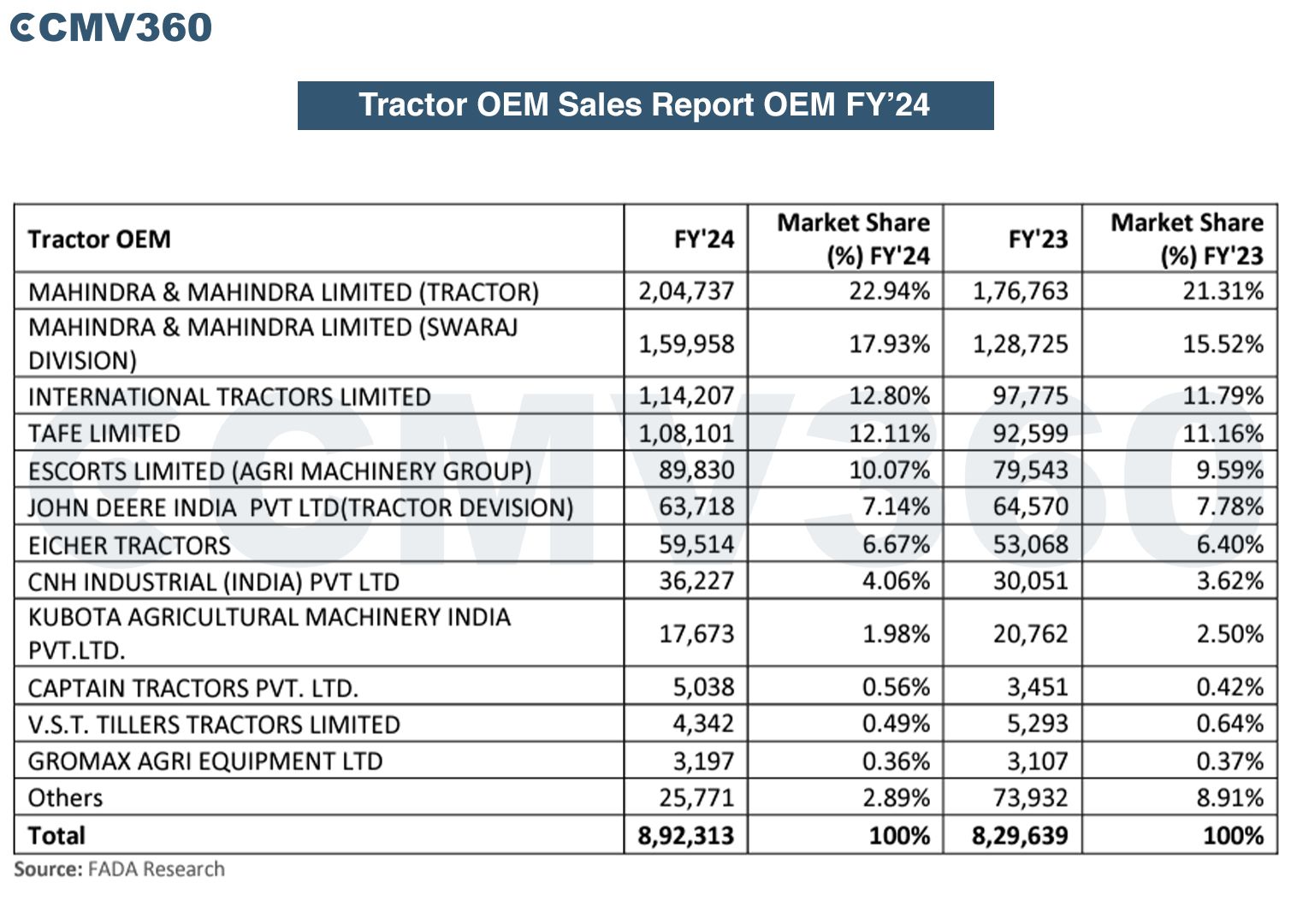

Tractor OEM Market Sees Growth in FY'24: Mahindra & Mahindra Limited Leads

Key Highlights

- Mahindra & Mahindra Limited led FY'24 tractor sales, showcasing industry dominance.

- Other OEMs displayed diverse performances in the Indian tractor market during FY'24.

- Despite challenges, the sector exhibited resilience and potential for continued growth.

- Mahindra & Mahindra Limited's strong performance reflects market adaptability and customer preference.

In the fiscal year 2024 (FY'24), the Tractor OEM market witnessed significant growth, with Mahindra & Mahindra Limited emerging as the leading player, according to recent market data. The company's tractor division saw notable growth in both sales volume and market share compared to the previous fiscal year.

Also Read: Domestic Tractor Sales Witness a Decline of 7.07% in FY24: Industry Reports 8,74,504 Tractors Sold

Overall Industry Trends

The Indian tractor industry witnessed diverse performances among OEMs in the fiscal year 2023-24. While some companies recorded robust growth, others faced challenges in sustaining their sales figures. Nevertheless, the industry as a whole demonstrated resilience and adaptability.

Also Read: Tractor Retail Sales Report March 2024: Mahindra & Mahindra Leads the Market

In FY'24, the Indian tractor industry collectively recorded total sales of 8,92,313 units. This represents a notable increase from the previous fiscal year's sales figure of 8,29,639 units, demonstrating the sector's overall growth and resilience amidst changing market dynamics.

Market Share Comparison: FY'24 vs. FY'23

Mahindra & Mahindra Limited (Tractor Division)

In the fiscal year 2023-24, Mahindra & Mahindra Limited's tractor division emerged as the top performer in the Indian tractor industry. The company recorded sales of 2,04,737 units, reflecting a market share of 22.94%. This marks a significant increase from the previous fiscal year, where the company sold 1,76,763 units, securing a market share of 21.31%. Mahindra & Mahindra Limited's consistent growth underscores its leading position in the market and its ability to cater to the evolving needs of farmers across India.

Swaraj Division of Mahindra & Mahindra Limited

The Swaraj Division of Mahindra & Mahindra Limited showcased robust performance in the fiscal year 2023-24. With sales reaching 1,59,958 units, the division captured a market share of 17.93%, marking a substantial increase from the previous fiscal year's figures of 1,28,725 units and a market share of 15.52%. Swaraj's strong performance highlights its commitment to delivering quality products and services to farmers and reinforces its position as a key player in the Indian tractor market.

International Tractors Limited

International Tractors Limited demonstrated impressive performance in the fiscal year 2023-24, securing the third position in the Indian tractor industry. The company recorded sales of 1,14,207 units, representing a market share of 12.80%. This reflects a notable increase from the previous fiscal year, where the company sold 97,775 units, with a market share of 11.79%. International Tractors Limited's growth trajectory underscores its ability to compete effectively in the market and its focus on meeting the needs of farmers with innovative and reliable tractor solutions.

Also Read: Domestic Tractor Sales Declined by 22.67% in March 2024: 63,755 Units Sold

TAFE Limited

TAFE Limited continued its steady growth trajectory in the fiscal year 2023-24, further solidifying its position in the Indian tractor industry. The company recorded sales of 1,08,101 units, capturing a market share of 12.11%. This marks an increase from the previous fiscal year, where TAFE sold 92,599 units, with a market share of 11.16%. TAFE's consistent performance reflects its commitment to excellence and its ability to adapt to changing market dynamics, making it a trusted choice among farmers nationwide.

Escorts Limited (Agri Machinery Group)

Escorts Limited's Agri Machinery Group showcased strong performance in the fiscal year 2023-24, reaffirming its position as a key player in the Indian tractor industry. With sales reaching 89,830 units, the company captured a market share of 10.07%, compared to 79,543 units and a market share of 9.59% in the previous fiscal year. Escorts Limited's focus on innovation and customer satisfaction has contributed to its growth and market leadership in the agricultural machinery segment.

John Deere India Pvt Ltd

John Deere India Pvt Ltd maintained its competitive position in the Indian tractor industry in the fiscal year 2023-24. The company recorded sales of 63,718 units, representing a market share of 7.14%. While there was a slight decrease from the previous fiscal year's sales of 64,570 units and a market share of 7.78%, John Deere India Pvt Ltd continues to be a formidable player in the market, known for its advanced technology and reliable products.

Eicher Tractors

Eicher Tractors demonstrated growth in sales in the fiscal year 2023-24, reflecting its expanding presence in the Indian tractor market. With sales of 59,514 units, the company captured a market share of 6.67%, compared to 53,068 units and a market share of 6.40% in the previous fiscal year. Eicher Tractors' focus on offering value-driven solutions and building strong customer relationships has contributed to its positive performance and market acceptance.

CNH Industrial (India) Pvt Ltd

CNH Industrial (India) Pvt Ltd witnessed growth in sales in the fiscal year 2023-24, indicating its growing traction in the Indian tractor market. The company recorded sales of 36,227 units, reflecting a market share of 4.06%, compared to 30,051 units and a market share of 3.62% in the previous fiscal year. CNH Industrial's emphasis on innovation and sustainability has resonated well with customers, driving its sales growth and market expansion.

Kubota Agricultural Machinery India Pvt.Ltd.

Kubota Agricultural Machinery India Pvt. Ltd. experienced a decrease in sales in the fiscal year 2023-24, reflecting challenges in the Indian tractor market. With sales declining from 20,762 units in the previous fiscal year to 17,673 units, the company captured a market share of 1.98% in FY'24, compared to 2.50% in FY'23. Despite this decline, Kubota Agricultural Machinery India Pvt. Ltd. remains focused on enhancing its product offerings and strengthening its market presence.

Captain Tractors Pvt. Ltd.

Captain Tractors Pvt. Ltd. maintained a modest performance in the fiscal year 2023-24, reflecting its niche position in the Indian tractor market. With sales of 5,038 units, the company captured a market share of 0.56%, compared to 3,451 units and a market share of 0.42% in the previous fiscal year. Captain Tractors' focus on specialized products and niche segments has contributed to its consistent performance and customer loyalty.

V.S.T. Tillers Tractors Limited

V.S.T. Tillers Tractors Limited witnessed a decrease in sales in the fiscal year 2023-24, reflecting challenges in the Indian tractor market. With sales declining from 5,293 units in the previous fiscal year to 4,342 units, the company captured a market share of 0.49% in FY'24, compared to 0.64% in FY'23. V.S.T. Tillers Tractors Limited remains focused on addressing market dynamics and enhancing its competitiveness to drive future growth.

Gromax Agri Equipment Ltd

Gromax Agri Equipment Ltd faced a marginal decline in sales in the fiscal year 2023-24, reflecting competitive pressures in the Indian tractor market. With sales of 3,197 units, the company captured a market share of 0.36%, compared to 3,107 units and a market share of 0.37% in the previous fiscal year. Gromax Agri Equipment Ltd remains committed to innovation and customer satisfaction to navigate market challenges and drive sustainable growth.

Also Read: Kenji Ennyu was Appointed as the Chief Officer in the Operation Division of Escorts Kubota

Other key players in the market also saw growth in sales and market share, contributing to the overall positive performance of the Tractor OEM sector in FY'24. The growth in demand for tractors can be attributed to various factors such as favorable government policies, increased mechanization in agriculture, and a rise in disposable income among rural consumers. The outlook for the Tractor OEM market remains optimistic, with projections indicating sustained growth in the coming years, driven by technological advancements and evolving agricultural practices.

CMV360 Says

The Indian tractor industry in FY'24 saw Mahindra & Mahindra Limited leading with strong sales. While some OEMs experienced growth, others faced challenges. Overall, the sector displayed resilience, promising further growth, and innovation to meet the evolving needs of farmers and sustain its crucial role in agriculture.

News

VST Tractor Sales Report for March 2025: Power Tillers See Big Growth, Tractor Sales Decline

VST Tractor March 2025 sales rise 63.63%, power tillers grow 77.81%, and tractors dip 11.94%....

01-Apr-25 09:48 AM

Read Full NewsMahindra Tractors March 2025 Sales: 32,582 Units Sold, 34% Growth

Mahindra sold 32,582 tractors in March 2025, recording 34% growth. Total sales reached 34,934 units, including exports....

01-Apr-25 06:55 AM

Read Full NewsEscorts Kubota Tractor Sales Report March 2025: 10,775 Tractors Sold, 15.2% Growth

Escorts Kubota sold 11,374 tractors in March 2025, marking a 15% growth. Domestic sales rose by 15.2%, exports by 12.4%....

01-Apr-25 06:01 AM

Read Full NewsChange in Tractor Subsidy Rules: Know the New Process to Get Benefits

Learn about the latest changes in tractor subsidy rules and how farmers can benefit from the new process....

31-Mar-25 11:16 AM

Read Full NewsCaptain Tractors Expands into Argentina with VIALCAM S.A.

Captain Tractors partners with VIALCAM S.A. to expand in Argentina, strengthening trade ties and offering quality agricultural solutions....

26-Mar-25 09:05 AM

Read Full NewsACE Launches 4WD Variant of Chetak DI 65 Tractor at 117th Farmers Fair

ACE launches the 4WD Chetak DI 65 tractor with a 50 HP engine, 2000 kg lifting capacity, and power steering....

24-Mar-25 06:30 AM

Read Full NewsAd

Ad

Latest Articles

Comprehensive Guide to Tractor Transmission System: Types, Functions, and Future Innovations

12-Mar-2025

Modern Tractors and Precision Farming: Transforming Agriculture for Sustainability

05-Feb-2025

Top 10 Tractors Under 30 HP in India 2025: Guide

03-Feb-2025

New Holland 3630 TX Super Plus vs Farmtrac 60 PowerMaxx: Detailed Comparison

15-Jan-2025

Swaraj 735 FE Vs Eicher 380 2WD Prima G3: Detailed Comparison

14-Jan-2025

How to Choose the Perfect Tractor for Your Farm: A Comprehensive Guide

09-Jan-2025

View All Articles

As featured on:

Registered Office Address

Delente Technologies Pvt. Ltd.

M3M Cosmopolitan, 12th Cosmopolitan,

Golf Course Ext Rd, Sector 66, Gurugram, Haryana

pincode - 122002