Retail Tractor Sales Report for August 2024: A Decline of 11.39%

0 Views

Updated On:

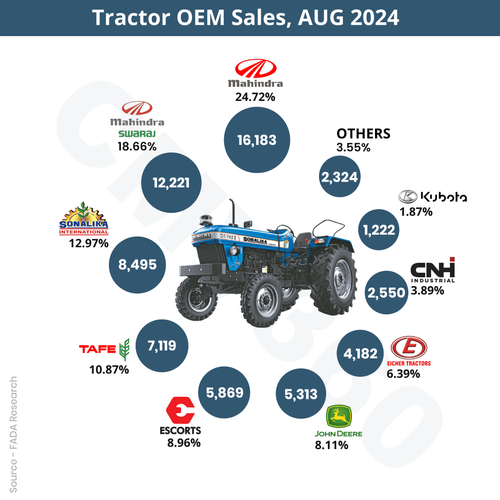

The Indian tractor market saw shifts in August 2024, with Mahindra & Mahindra leading, while others faced competitive challenges.

Key Highlights

- Mahindra & Mahindra leads with 24.72% market share in August 2024.

- Swaraj division holds 18.66% share, slightly up from last year.

- International Tractors Limited increases market share to 12.97%.

- TAFE sees a decline, dropping to 10.87% market share.

- John Deere grows to 8.11%, improving from 6.63% in 2023.

On September 5, 2024, the Federation of Automobile Dealers Associations (FADA) released the retail tractor sales data for August 2024. The report highlights a significant decline of 11.39% in tractor sales compared to the same month last year. A total of 65,478 tractors were sold in August 2024, down from 73,892 units sold in August 2023. This decline reflects changing market dynamics, with some major brands adjusting their positions in response to competitive pressures and shifting demand.

Sales Performance by Brand

Here is the table displaying the Tractor OEM market share for August 2024 and August 2023:

Tractor OEM | AUG'24 Sales | Market Share (%) AUG'24 | AUG'23 Sales | Market Share (%) AUG'23 |

Mahindra & Mahindra Limited (Tractor Division) | 16,183 | 24.72% | 17,929 | 24.26% |

Mahindra & Mahindra Limited (Swaraj Division) | 12,221 | 18.66% | 13,413 | 18.15% |

International Tractors Limited | 8,495 | 12.97% | 8,458 | 11.45% |

TAFE Limited | 7,119 | 10.87% | 9,564 | 12.94% |

Escorts Kubota Limited (Agri Machinery Group) | 5,869 | 8.96% | 7,433 | 10.06% |

John Deere India Pvt. Ltd. (Tractor Division) | 5,313 | 8.11% | 4,900 | 6.63% |

Eicher Tractors | 4,182 | 6.39% | 4,962 | 6.72% |

CNH Industrial (India) Pvt. Ltd. | 2,550 | 3.89% | 2,383 | 3.22% |

Kubota Agricultural Machinery India Pvt. Ltd. | 1,222 | 1.87% | 1,506 | 2.04% |

Others | 2,324 | 3.55% | 3,344 | 4.53% |

Total | 65,478 | 100% | 73,892 | 100% |

Brand-Specific Insights

Mahindra & Mahindra Limited (Tractor Division)

Mahindra & Mahindra remained the market leader in August 2024, despite a drop in sales. The company sold 16,183 units, capturing 24.72% of the market. This is a slight increase in market share from 24.26% in August 2023, although sales were down from 17,929 units in the same period last year. Mahindra's strong brand presence and trusted quality continue to keep it in the top spot.

Mahindra & Mahindra Limited (Swaraj Division)

The Swaraj tractors, a sub-brand of Mahindra & Mahindra, also maintained a significant position in the market. In August 2024, Swaraj sold 12,221 units, achieving an 18.66% market share, up from 18.15% in August 2023, when it sold 13,413 units. While sales decreased year-on-year, the division’s market share rose slightly, highlighting its consistent performance.

International Tractors Limited (Sonalika)

International Tractors Limited (ITL), known for its Sonalika brand, saw a boost in market share. In August 2024, ITL sold 8,495 units, increasing its market share to 12.97% from 11.45% in August 2023, when it sold 8,458 units. This improvement reflects the brand’s growing customer base and competitive positioning in the tractor market.

TAFE Limited

TAFE Limited, a major player in the industry, experienced a decline in both sales and market share. In August 2024, TAFE sold 7,119 units, capturing 10.87% of the market, a decrease from 12.94% in August 2023, when it sold 9,564 units. The drop in sales and share points to competitive pressures the brand has faced in recent months.

Escorts Kubota Limited (Agri Machinery Group)

Escorts Kubota saw a drop in its market performance in August 2024. The company sold 5,869 units, down from 7,433 units in August 2023. This resulted in a reduced market share of 8.96%, compared to 10.06% the previous year. The brand is facing increased competition, but it remains a significant player in the sector.

John Deere India Pvt. Ltd. (Tractor Division)

John Deere India showed positive growth in August 2024, with sales increasing to 5,313 units from 4,900 units in August 2023. The company's market share rose from 6.63% to 8.11%, demonstrating the brand's rising influence and growing customer preference for its tractors.

Eicher Tractors

Eicher Tractors, another well-known brand, sold 4,182 units in August 2024, holding a market share of 6.39%. This is a slight decrease from August 2023, when it sold 4,962 units, with a market share of 6.72%. The brand continues to face competition from other key players in the industry.

CNH Industrial (India) Pvt. Ltd.

CNH Industrial showed steady improvement in August 2024, selling 2,550 units and increasing its market share to 3.89% from 3.22% in August 2023, when it sold 2,383 units. This indicates growing traction for CNH in the Indian market, with the company steadily gaining ground.

Kubota Agricultural Machinery India Pvt. Ltd.

Kubota Agricultural Machinery experienced a drop in both sales and market share in August 2024. The company sold 1,222 units, down from 1,506 units in August 2023, resulting in a market share decrease from 2.04% to 1.87%. The brand is working to regain its foothold amidst increasing competition.

Others (Smaller Brands and Manufacturers)

Smaller brands and manufacturers, categorized as "Others," saw a notable decline in August 2024. Total sales dropped to 2,324 units from 3,344 units in August 2023. Consequently, their market share decreased from 4.53% to 3.55%, indicating that the larger brands are consolidating their positions in the market.

Also Read: Domestic Tractors Sales Report August 2024: 5.39% Sales Drop, 50,134 Units Sold

CMV360 Says

Mahindra & Mahindra, both in its main brand and Swaraj division, continues to lead the market, while brands like John Deere and International Tractors Limited are gaining momentum. TAFE, Escorts Kubota, and others face increased competition and challenges in maintaining their market positions. The overall market remains competitive, with several brands competing for growth despite an overall decline in sales for August 2024.